Japan is recovering from the consumption tax hike last April that tipped the economy into a technical recession, but growth remains slow as the impact of 'Abenomics' is limited, a former Bank of Japan (BOJ) executive director told CNBC.

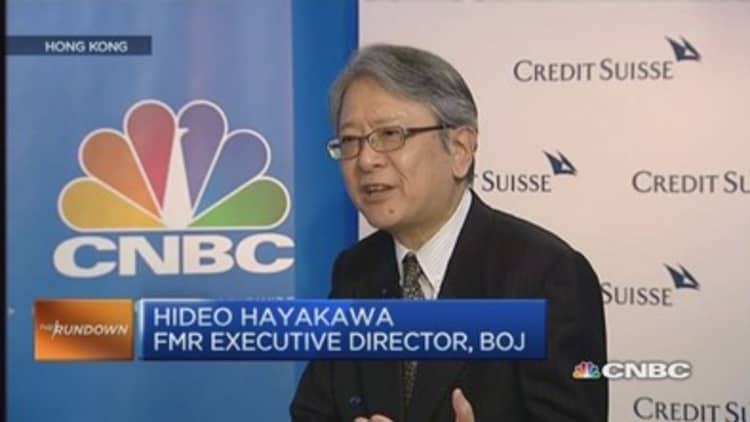

"Many people exaggerate the negative impact of the sales tax (hike)….the tax hike slump was a short one, the economy hit bottom last August and many people expect robust growth in the first-quarter of this year," Hideo Hayakawa told CNBC at the 18th annual Credit Suisse Asian Investment Conference in Hong Kong on Tuesday.

Japan's economy expanded an annualized 0.4 percent in the fourth quarter of 2014, rebounding after two quarters of contraction following the consumption tax hike to 8 percent from 5 percent last April.

But Hayakawa conceded that growth remains slow as Prime Minister Shinzo Abe's economic policies, dubbed "Abenomics", have only had a limited impact: "Improvement in real economic activity is pretty limited and growth [is] still very low."

After Japan's economy contracted 0.5 percent in fiscal 2014, the government expects it to expand by 1.5 percent in fiscal 2015.

Benefits of weaker yen mixed

The benefits of a weaker yen are mixed, Hayakawa said, in the wake of the currency's sharp decline against the U.S. dollar.

The yen began to weaken right before Prime Minister Shinzo Abe's reelection in December 2012, falling from just over 80 yen against the U.S. dollar to 98 yen just before the BOJ launched its unprecedented quantitative easing (QE) program in April 2013.The yen has since weakened November, to 119.75 on the back of the BOJ's QE effort, which the central bank expanded last October.

"The depreciation from 80 to 100 yen [was] welcomed by many people, but the further weakening to 120 yen has been more mixed," said Hayakawa, noting that the weaker yen has eroded the purchasing power of Japanese consumers.

"It depends on [what] sort of price index you use, but usually 90 to 100 yen is consistent with purchasing power parity levels," he said.